Cedar Hill’s sector focus reflects broader shifts in venture capital. During India’s startup boom, generalist funds dominated early-stage investing. But tightening liquidity and increased scrutiny on business fundamentals have revived interest in specialised sector expertise.

Cedar Hill’s sector focus reflects broader shifts in venture capital. During India’s startup boom, generalist funds dominated early-stage investing. But tightening liquidity and increased scrutiny on business fundamentals have revived interest in specialised sector expertise.Venture capital has long been associated with capital that helps founders scale faster. But as funding cycles tighten and startup mortality becomes more visible, investors are increasingly confronting a harder question: what happens after the cheque is written?

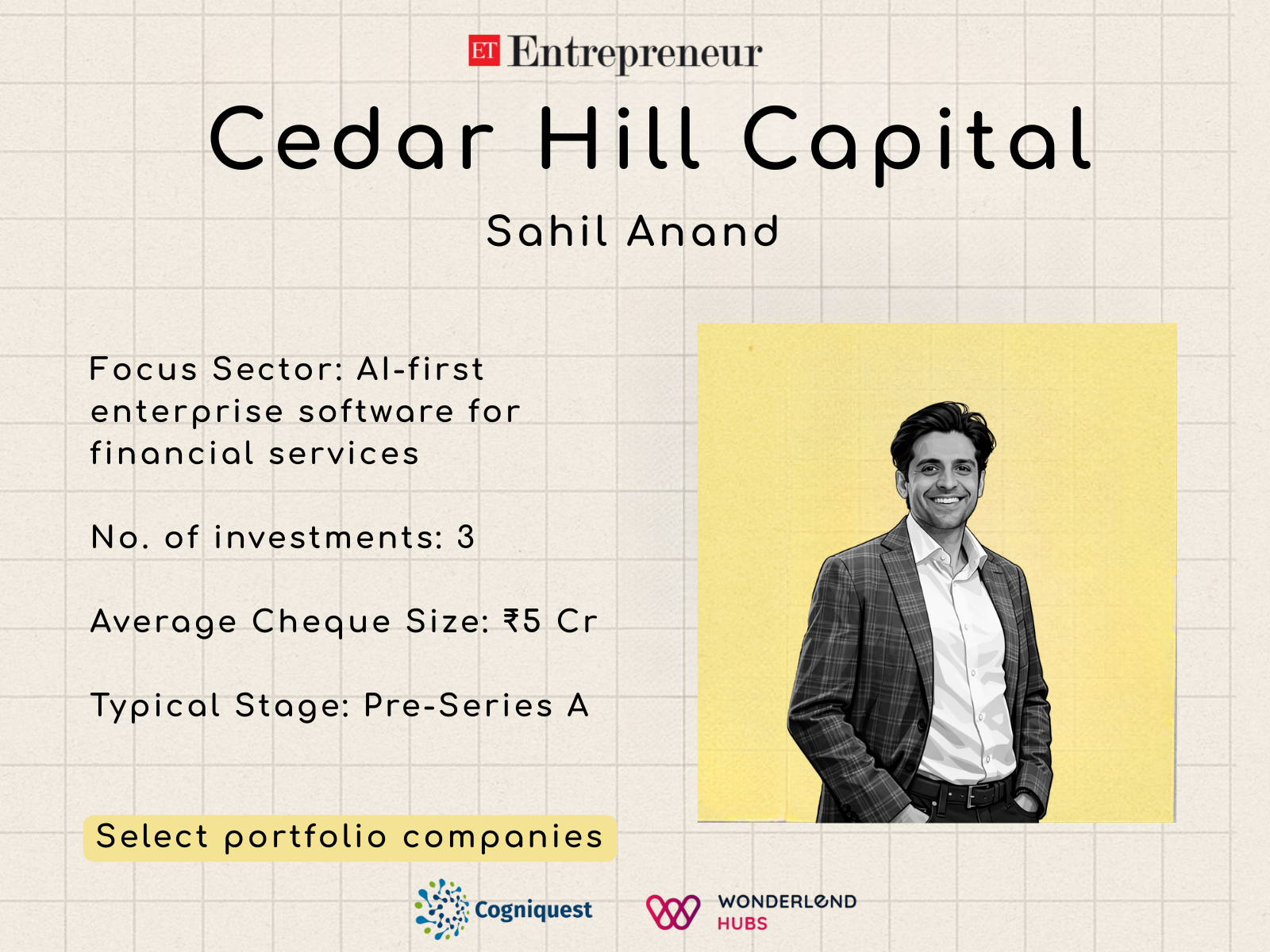

For Sahil Anand, founder of Cedar Hill Capital, capital must do more than sustain companies.

“If capital is not helping founders build, expand, and navigate markets, then it is not really doing its job,” Anand said.

Launched as a fund focused on B2B fintech and enterprise software for the BFSI sector, Cedar Hill typically invests ₹5-10 crore in companies that already have early enterprise customers.

The strategy deliberately avoids idea-stage investing, reflecting Anand’s belief that enterprise adoption creates stronger defensibility.

Anand’s philosophy is shaped by his own journey. He studied finance at NYU’s Stern School of Business before joining private equity firm Everstone Capital. There, he gained exposure to transactions across sectors but credits one experience with shaping his approach to investing: the expansion of Burger King in India.

For nearly three years, Anand worked closely with operating teams as the brand scaled its footprint, participating in decisions ranging from hiring leadership to product development.

“It taught me that investing is not just financial modelling,” he said. “If you really want companies to succeed, you have to be involved in how they build.”

After Everstone, Anand worked with DSG Consumer Partners. His pivot toward fintech came through building the Cedar IBSI FinTech Lab, an accelerator platform that helps enterprise fintech startups expand into global markets. Since then, Anand has worked closely with dozens of companies navigating product strategy, partnerships, and cross-border expansion.

Specialisation becoming an edge

Cedar Hill’s sector focus reflects broader shifts in venture capital. During India’s startup boom, generalist funds dominated early-stage investing. But tightening liquidity and increased scrutiny on business fundamentals have revived interest in specialised sector expertise.

Anand believes enterprise fintech remains underinvested despite India’s rapid growth in digital financial infrastructure.

“A lot of fintech investing in the last decade has been consumer-focused,” he said. “But the infrastructure powering banks and insurance companies is still undergoing transformation.”

The distinction between B2B and B2C fintech has sharpened further with artificial intelligence. Consumer-facing knowledge platforms increasingly compete with large AI models that replicate informational services at scale. Enterprise technology, Anand argues, operates differently.

“Enterprise clients need consistency, integration, and reliability,” he said. “You cannot replace mission-critical workflows with generic AI outputs.”

The fund sits at the intersection of fintech infrastructure, enterprise SaaS, and AI-driven workflow automation.

The differentiator

Cedar Hill’s key differentiator is its integration with the broader Cedar ecosystem, which includes consulting firm Cedar Consulting, research platform IBS Intelligence, and a global fintech accelerator network.

This ecosystem provides access to relationships with banks, insurers, and enterprise technology buyers across India, the Middle East, Europe, and North America.

Our value proposition to founders is that we can help them reach customers faster.Sahil Anand

Portfolio companies are introduced to enterprise buyers and supported on product positioning, partnerships, and go-to-market strategy. The fund maintains close engagement with founders, often working directly with leadership teams.

Cedar Hill plans to invest in about 12 to 15 companies, allowing deeper operational involvement.

“Entrepreneurship can be isolating,” Anand said. “Founders need investors who can act as sounding boards, not just shareholders.”

The portfolio reflects Cedar Hill’s focus on enterprise workflow transformation. One of its early investments, Cogniquest AI, uses AI to extract structured data from unstructured financial documents, improving efficiency across loan processing, insurance claims, and compliance workflows.

Another portfolio company, Wonderlend, builds software that automates commission calculations for insurance and banking sales teams, replacing manual spreadsheet-based systems that have persisted for decades.

The fund is also exploring fraud detection technologies using behavioural analytics and device intelligence to identify suspicious activity during customer onboarding.

Across investments, Anand sees a consistent opportunity: modernising legacy enterprise processes that have historically resisted technological disruption.

“The opportunity is not just new technology,” he said. “It is solving problems that have existed inside financial institutions for years.”

Scaling fintech in a changing landscape

Cedar Hill is getting started at a time when the broader venture capital ecosystem is undergoing a structural change. Anand points to the growing trend of family offices shifting toward direct startup investments, reducing capital available for early-stage funds.

“There is a strong desire among investors to engage directly with founders,” he said. “That changes how funds have to position themselves.”

Raising a first-time fund in this environment requires clear differentiation. Anand believes sector expertise is increasingly becoming a prerequisite for attracting both founders and institutional investors.

For enterprise fintech startups, scaling beyond India is critical. While domestic BFSI adoption helps companies reach early revenue milestones, international expansion often becomes necessary for sustained growth.

“India gives you the first set of customers,” Anand said. “But enterprise fintech companies typically need international markets to scale meaningfully.”

Through its consulting and accelerator networks, Cedar Hill helps portfolio companies build relationships across financial ecosystems in the Middle East and Europe, acting as a bridge between Indian startups and global enterprise buyers.

Enterprise fintech also tends to follow a different risk profile compared with consumer startups. Once integrated into operational workflows, enterprise software is rarely replaced abruptly, reducing the likelihood of complete revenue collapse.

“The worst-case scenario in many B2B fintech companies is not failure,” Anand said. “It is plateauing.”

Such companies often become acquisition targets for larger financial technology firms seeking domain-specific capabilities. Cedar Hill’s exit strategy therefore emphasises strategic acquisitions alongside later-stage venture rounds.

As India’s fintech ecosystem matures and enterprise software becomes increasingly global, Anand believes venture capital itself must evolve from capital provider to strategic collaborator.

“Markets will always go through cycles,” he said. “But if you stay focused on helping companies build real businesses, capital will always find its place.”

Leave a Reply