While the firm’s second fund limited them to small ownership stakes, the current fund allows Neon to take 7–13 per cent positions, lead rounds, and create cap tables that include operators who have earlier scaled companies.

While the firm’s second fund limited them to small ownership stakes, the current fund allows Neon to take 7–13 per cent positions, lead rounds, and create cap tables that include operators who have earlier scaled companies.The story of Neon Fund is a contrarian story of its own.

It was in 2012 when Siddhartha Ahluwalia built his first startup AddoDoc, a pediatric clinic software, at a time when the Indian SaaS sector was still finding its footing.

Over time, the firm ended up serving more than 100 hospitals, managing over a million patient records, and running a parenting app used by nearly a million mothers every month.

The first cheque came from Rajul Garg, founder of GlobalLogic and Pine Labs. Five years later, AddoDoc was acquired by Sheroes. On paper, it was the kind of outcome founders are usually trained to move on from.

Yet, the acquisition left Ahluwalia and his co-founder in life, Nansi Mishra, with a familiar itch of building something again.

That’s when the husband-wife duo looked at venture capital as the next best step. They had lived the founder journey end to end, swooped in cheques, built the product, and exited a company. If anyone understood startups from the inside, it was them.

“I applied to VC firms after we exited,” Siddharth Ahluwalia, managing partner at Neon Fund told ETEntrepreneur.

“We were outsiders. We didn’t know anything about venture capital. They would often say, ‘You’re neither from McKinsey nor Ivy League, you’re unfit to be a VC,” he added.

However, the rejections directed them towards a different path. Instead of asking for a seat at the table, the couple decided to assemble one of their own and invite everyone to sit around it.

In 2018, armed with a smartphone and coupled with curiosity, Ahluwalia and Mishra started the 100X Entrepreneur Podcast. The duo had one audacious question repeated to every investor who’d spare them time: what made them take the leap of faith in signing off the cheque?

Somewhere between listening and learning, they realised they had built a thesis of their own.

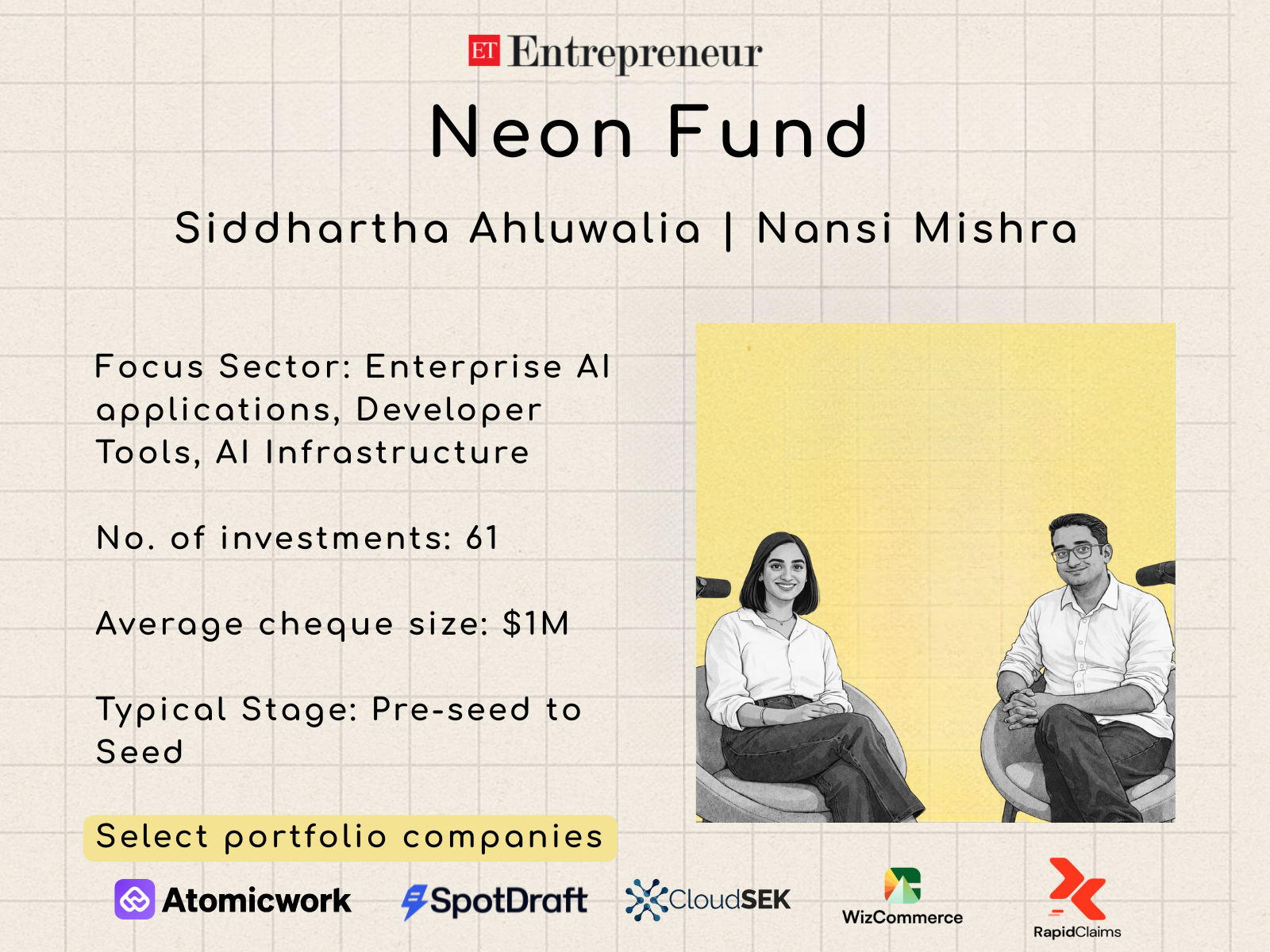

This led to the inception of Neon Fund, an early-stage fund focused on enterprise AI, an extension of the conversations they had been having for six years through the podcast, now titled as The Neon Show.

“The podcast had become a way to break into the first 100 guests for all VCs. That’s how we started building a community of entrepreneurs who wanted to raise from tier-one investors, along with people who wanted to learn how their thesis worked,” said Mishra.

Conversations over capital

Week after week, episode after episode, the recordings stacked up like building blocks. By 2020, the VC firm had garnered over 200 conversations.

The podcast so far has featured leading voices from the startup ecosystem, including Tarun Mehta (Ather Energy), Vineeta Singh (SUGAR Cosmetics), Sanjeev Bikhchandani (Info Edge), Aadit Palicha (Zepto), among others.

Mishra recalls how in 2019, the podcast had begun exerting a pull of its own. Second-time founders, often fresh from their own exits, reached out a little less for capital but more for the community advantage.

Lalit Mangal, who had co-founded CommonFloor (later acquired by Quikr) and was gearing up to launch Airmeet, reached out to them. This early investment, made under the 100X Entrepreneur Fund, became the fund’s first defining bet.

Similar interest came from Saurabh Arora, whose startup Airwoot was acquired by Nasdaq-listed Freshworks and who later co-founded Plum Insurance.

“We didn’t even have a fund at the time,” Ahluwalia said. “But they saw the podcast as an asset they wanted to build alongside. In many ways, second-time founders pulled the fund out of us.”

This resulted in their first fund of $2 million pooled through scaled tech founders from companies like Tracxn, Fusion Charts, Wingify, and Fynd.

Earlier this week, they closed their third fund at $25 million and have already backed startups such as Atomicwork, Zepic, RapidClaims, Featurely, and WizCommerce.

The latest fund has secured commitments from the likes of Foundation Capital, RTP Global and Play Capital.

Because their earliest inbound pipeline came from repeat founders, Neon designed its portfolio intentionally: half the fund goes to second-time founders, the other half to first-time founders, sometimes fresh out of college.

Early conviction in AI

The firm backed enterprise-first companies and applied AI long before the market caught on.

Those early convictions echo in Neon’s portfolio. SpotDraft was using AI to generate first-draft legal contracts in 2019. CloudSEK built AI-driven threat intelligence tools around the same time. inFeedo deployed conversational AI for employee sentiment long before such use cases gained mainstream interest.

“These were companies well-positioned to hit 10 million ARR irrespective of VC investment,” Ahluwalia said.

Perhaps the strongest signal of trust comes from founders who have built and exited multiple companies.

This includes companies such as Atomicwork, built by the founders of Minjar (acquired by Nutanix) and Freshworks; GTMBuddy, founded by the creator of Gainsight; and Budy.bot, started by the founder of GreyOrange Robotics, among others.

While the firm’s second fund, which had a corpus of $11 million, limited them to small ownership stakes, the current fund allows Neon to take 7–13 per cent positions, lead rounds, and create cap tables that include operators who have earlier scaled companies.

However, the journey was anything but an easy feat. Ahluwalia recalled close to 1,000 LP meetings across 15–20 countries, including sessions in the US, London, Vienna, Oslo, and Singapore.

Yet, their strongest leads came from the same place their journey once began: the podcast.

Mishra noted how several global institutional LPs have encountered Neon through YouTube’s algorithm. For instance, a Norwegian-based LP downloaded an internal Neon episode, which was shot on dining chairs the day the couple moved into their home and committed immediately on the first encounter.

“That was meant to be our first in-person meeting, where we expected a discussion before a decision. They walked in straight from the airport, shook hands, and said, ‘Hi, we’re in,’” she added.

Today, the podcast draws five million monthly views, serving as both the fund’s distribution engine and its cultural anchor.

The firm is now preparing its next investment vehicle, a $50 million Fund IV, slated for 2026.

Yet, despite the scale, very little has changed about how Neon operates. In many ways, the instinct to learn and compound quietly continues to define how the firm backs founders today.

Leave a Reply