Cactus deliberately avoids crowded pre-seed and seed investing. Instead, it focuses on companies that have crossed product-market fit and are entering the more capital-intensive phase of scaling.

Cactus deliberately avoids crowded pre-seed and seed investing. Instead, it focuses on companies that have crossed product-market fit and are entering the more capital-intensive phase of scaling.When Cactus Partners began investing in 2021, timing was hardly forgiving. Valuations were peaking, and capital was abundant. Within two years, the script had flipped. Funding tightened and the market began asking questions it had avoided for years.

For the three partners behind Cactus, the turbulence was not a surprise. It was, in many ways, the point.

Rajeev Kalambi and Amit Sharma did not come into venture capital through the same door, but they arrived with a shared scepticism of excess.

Rather than rushing to deploy capital, the partners chose discipline over momentum, a decision that would later shape the fund’s investment thesis.

From different paths to a shared thesis

Kalambi’s career moved through economics, media research, corporate banking and buy-side investing, exposing him to multiple market cycles. Sharma’s journey began in a small town in Haryana, progressed through self-taught English, equity research, and later building investment platforms across India and the Middle East.

“I’ve seen euphoric markets and stressed markets,” Sharma said. “That experience teaches you very quickly what really holds up.”

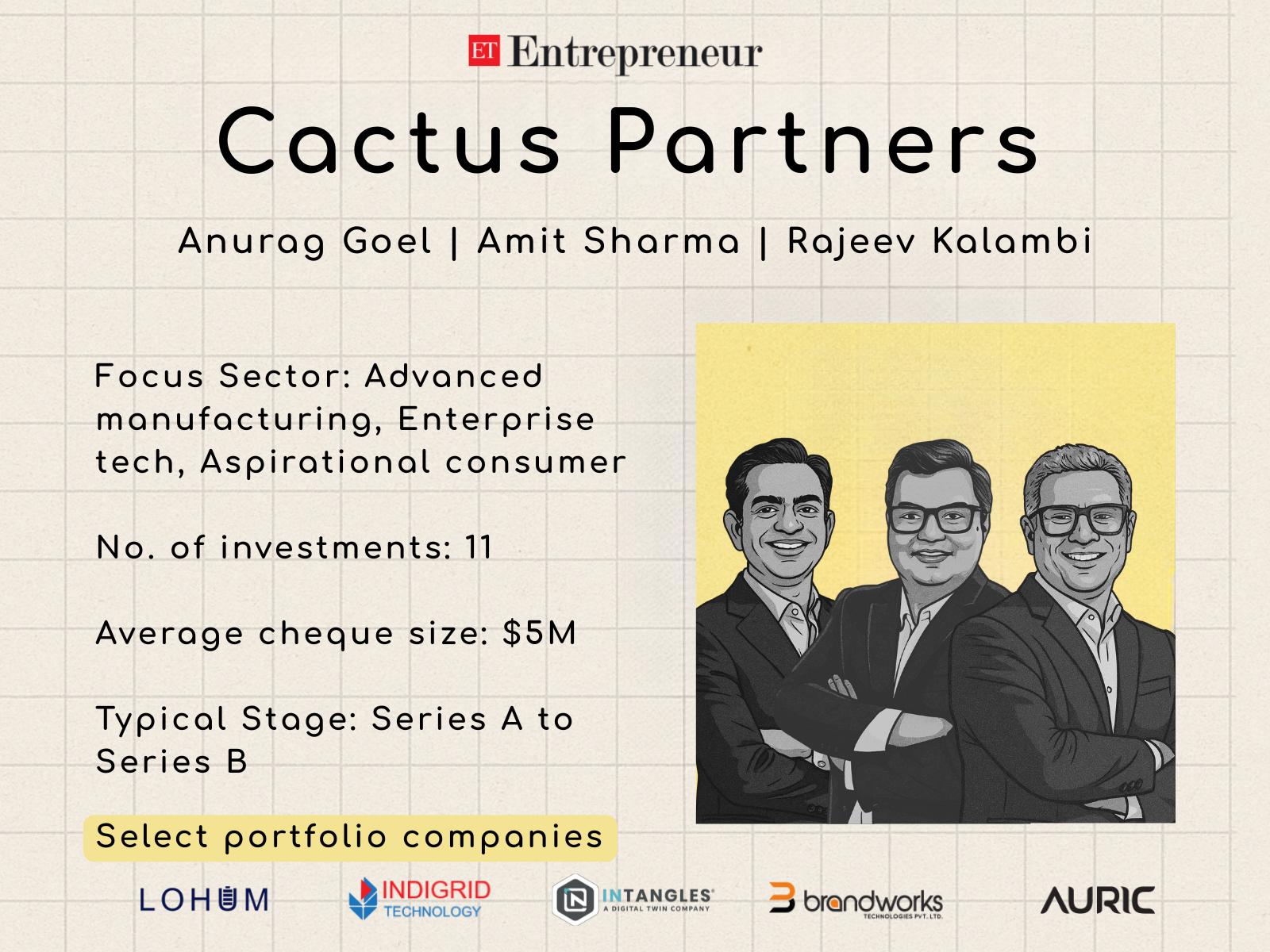

They met through Anurag Goel, the third partner and a seasoned operator, and spent nearly two years testing alignment before coming together. That prolonged courtship shaped the fund’s core belief: patience matters more than momentum.

“Anurag was the fulcrum,” Kalambi said. “He brought execution experience that most financial funds don’t have.”

Together, the trio settled on a clear position in the venture landscape: early growth equity.

Early growth, not early bets

Cactus deliberately avoids crowded pre-seed and seed investing. Instead, it focuses on companies that have crossed product-market fit and are entering the more capital-intensive phase of scaling.“There are plenty of funds at the bottom of the funnel,” Kalambi said. “There are far fewer once companies start scaling in a meaningful way.”

The strategy rests on three filters. First, companies must demonstrate a critical mass of revenue, not just growth purchased through discounts or incentives. Second, revenue must be sticky and recurring, signalling real value rather than transient demand. Third, businesses must show strong gross margins relative to their industry, creating room to adjust when markets turn.

“If you’re selling a dollar for 90 cents, people will buy but that doesn’t make it a business,” said Sharma. “Story matters but numbers matter more when cycles reverse.”

Cactus’ portfolio will hold no more than 15 companies, a deliberate cap designed to allow hands-on engagement. The partners see their role not merely as capital providers, but as sounding boards for founders navigating high-stress growth phases.

“Entrepreneurship is a lonely journey,” Kalambi said. “Founders need more than capital. They need perspective.”

The cactus metaphor that gives the firm its name is not accidental. A cactus survives in arid conditions, conserving resources, but grows rapidly when conditions improve.

So far, the approach has insulated the portfolio. The firm reports no write-offs or write-downs to date, though the partners are careful to call zero mortality an aspiration, not a guarantee.

Fundamentals over noise

The partners believe the next phase of India’s startup ecosystem will be defined by survival skills.

“Founders are now being forced to think about unit economics much earlier,” Kalambi said. “That shift is structural. It’s not going away even if capital becomes more abundant again.”

The firm’s sectoral focus is broad but intentional.

Manufacturing is expected to emerge as one of the strongest long-term themes over the next decade, driven by supply chain realignment and India’s push to move up the value curve. “Manufacturing is no longer a tactical opportunity,” Kalambi said. “It’s a decadal story.”

Enterprise technology remains a core focus, though the firm is cautious about hype cycles. “The real opportunity is where technology is essential to the business, not cosmetic,” added Kalambi.

On the consumer side, Sharma sees a slower but deeper evolution.

“Consumption will grow, but it will be more thoughtful,” he said. “As disposable incomes rise, people will pay for value, not just novelty.”

Cactus has completed 11 investments so far and expects to close Fund I with around 14 companies. Preparations are underway for the second fund, which is targeted at $180 million, more than double the size of the first which closed at about $77 million.

“The strategy won’t change just because the fund gets bigger,” Sharma said. “What changes is the ability to support companies through a longer part of their journey.”

Beyond individual funds, the partners emphasise institution-building as the central goal. “We’re not building this for one cycle,” Sharma said. “We’re building it for the next several decades.”

Kalambi echoed that view. “Cycles will come and go,” he said. “If you stay anchored to fundamentals, you don’t need to predict them. You just need to survive them.”

Leave a Reply